A recent article in the Fast Magazine highlights some leadership styles to adopt that can be applicable to logistics managers, providing a strategic outlook for navigating uncertainties in 2024. It outlines five distinctive leadership trends that may be tailored to the logistics industry:

- New Leadership Paradigm Logistics managers are urged to embrace a new set of leadership skills. Balancing between risk and accountability is emphasized, recognizing the need for both aspects in successful logistics operations.

- Revamped Leadership Development Traditional leadership development models are deemed inefficient. The article foresees a rise in innovative approaches using various technologies. Logistics managers are encouraged to leverage digital tools while focusing on the active ingredient of behaviour change: embedding new habits through sustained attention, strong insights, and committed action, facilitated by social interactions.

- Inclusive Leadership Integration In 2024, diversity, equity, and inclusion (DEI) initiatives are predicted to be seamlessly woven into the fabric of good leadership within the logistics sector. Given that logistics managers encounter various countries and cultures for product procurement, logistics managers are advised to incorporate bias education into everyday leadership training, recognizing it as an essential skill for sound decision-making and fostering high-performing teams.

- Performance Management Redefined With the rise of long-term hybrid workplaces, logistics managers are urged to rethink performance management strategies. The article highlights the challenges of managing accountability in remote settings while acknowledging and rewarding employees’ needs for status, autonomy, certainty, relatedness, and fairness.

- AI-Ready Leadership Anticipating a breakthrough year for artificial intelligence (AI), the article advises logistics managers to prepare for large-scale disruptions in logistics operations. While AI promises profitability and efficiency, managers are reminded to anticipate reskilling needs for their workforce, ensuring a smooth transition amid potential industrial changes.

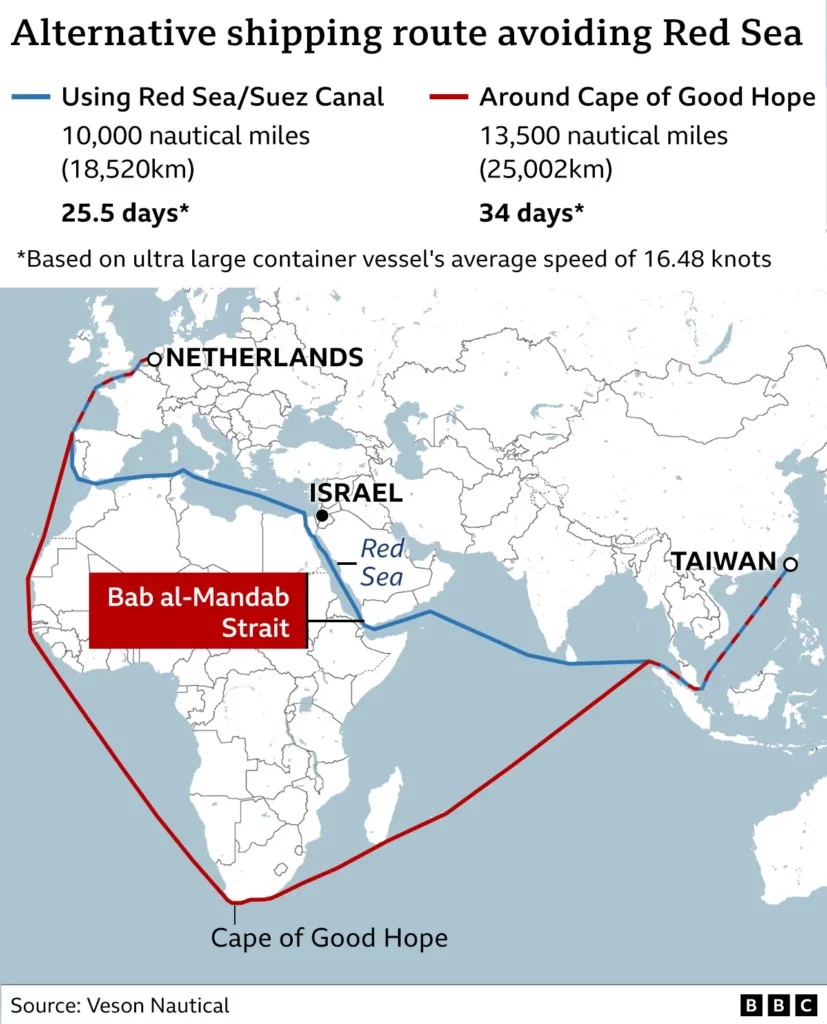

In the face of market uncertainties, the article encourages logistics managers to focus on creating clarity around strategies tailored specifically to the logistics industry in the coming year. With the Red Sea conflict, potential increase in costs, congestion, and other unpredictable weather-related events, the logistics manager may consult with external consultants.

If you have any concerns or questions, please do not hesitate to contact the sales team at Canaan Group.

Reference

Fast Company. (2024, January 2). “Leadership Trends to Watch in 2024.” Retrieved from https://www.fastcompany.com/90997604/leadership-trends-to-watch-in-2024?utm_source=newsletters&utm_medium=email&utm_campaign=FC%20-%20Compass%20Newsletter.Newsletter%20-%20FC%20-%20Compass%2012-30-23&leadId=10181018&mkt_tok=NjEwLUxFRS04NzIAAAGQWl-yAE2Rn2pLDVR1Y9z4aP5KwZ4cc-Nmy92azCvLPf1_MLTNw4MsY86GCOrrL8CSTM184sGW0DxOr6OPuizS6AJHwcUTNBMvAVlgHc_pWdI.