As the year begins in 2024, a notable shift is observed in the landscape of warehousing accessibility spanning both Canada and the United States. Even in traditionally constrained markets such as Vancouver, Los Angeles, and Chicago, an increased availability of warehousing space is discernible. This transformation is primarily attributed to the strategic destocking of inventories and the successful culmination of numerous construction endeavors across North America.

Colliers Market report reveals a noteworthy evolution in Canada’s industrial warehouse vacancy rates, ranging from 1.5% in Vancouver to 4.5% in Edmonton. Concurrently, the overall US warehousing vacancy rate has ascended to 4.9% as of the close of Q4 2023. While surpassing pre-pandemic averages, these rates suggest that capacity constraints persist, exerting pressure on costs within the realm of third-party logistics (3PL).

During the crazy times of COVID-19, finding a place to store and move goods was like searching for a needle in a haystack. Overstocked inventories precipitated a decline in the US vacancy rate to 3.4% by the conclusion of 2022. The subsequent phenomenon of the Great Destocking in 2023 witnessed a substantial 20% downturn in inflation-adjusted US inventories through September, albeit remaining 7% higher than 2019 levels. Consequently, warehousing vacancy rates rose to 4.9% by Q3 2023, below the pre-pandemic average of 7%, coupled with a 4.2% decline in employment.

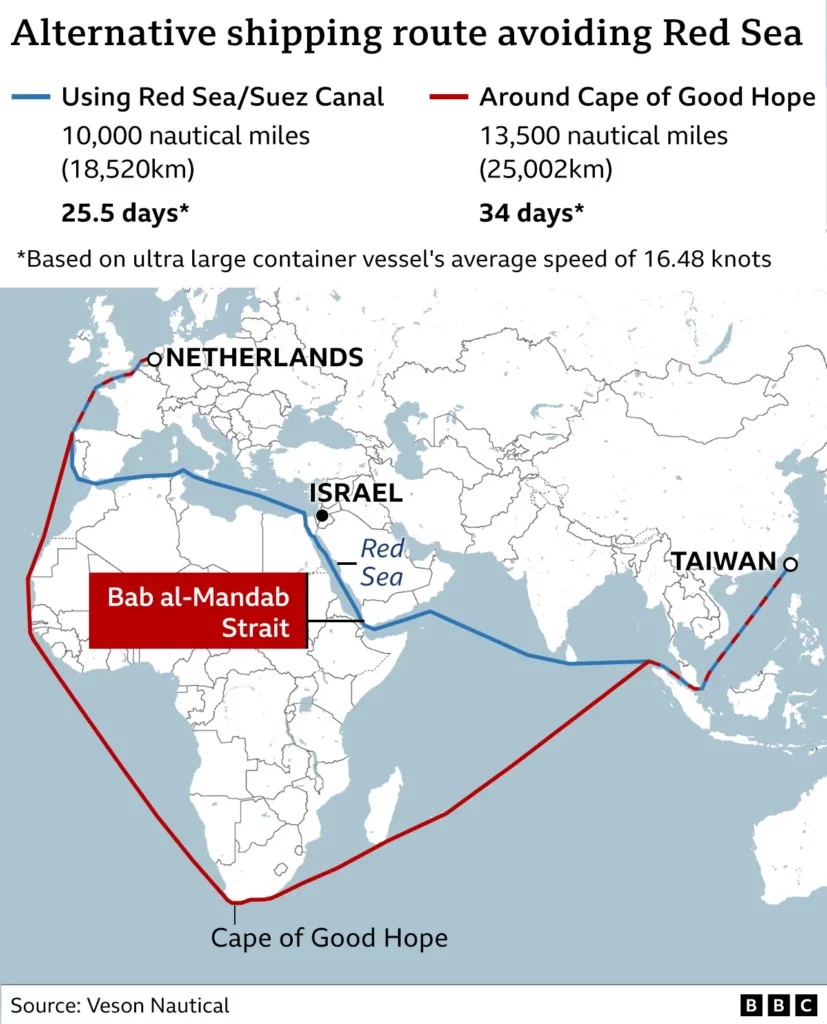

Looking ahead in 2024, numerous shippers display a cautious stance, deferring warehousing decisions considering the slowing down of economic growth in both Canada and the United States. In addition, there continues to be the completion of construction industrial warehousing projects. The trajectory of US Southeast port cities, from Norfolk to Savannah, witnessed a substantial surge in developmental initiatives in 2023, a trend anticipated to endure through 2024. Notably, the warehousing and cross-dock space in Laredo, Texas, the largest US-Mexico border crossing for truck freight, remains constrained. The ongoing diversification in US entry points is poised to incite heightened demand for warehousing and storage at inland nodes as cited in the Journal of Commerce. However, the uncertain events like the Red Sea attacks and the oscillating dynamics of on-shoring and off-shoring initiatives also cause certain companies to look at restocking more inventory to mitigate some of the delays in shipment.

For more information about your warehousing needs, please contact your local Canaan sales and customer service representative.